The global economic landscape witnessed a noteworthy subplot during the last BRICS conference in late August in Johannesburg, South Africa. Despite its absence from the official agenda, leaders from the Global South couldn't help but hint at the need to reduce the dominance of the US dollar in global trade and financial transactions. Notably, Brazilian President Luiz Inacio Lula da Silva dared to suggest the development of a new BRICS single currency.

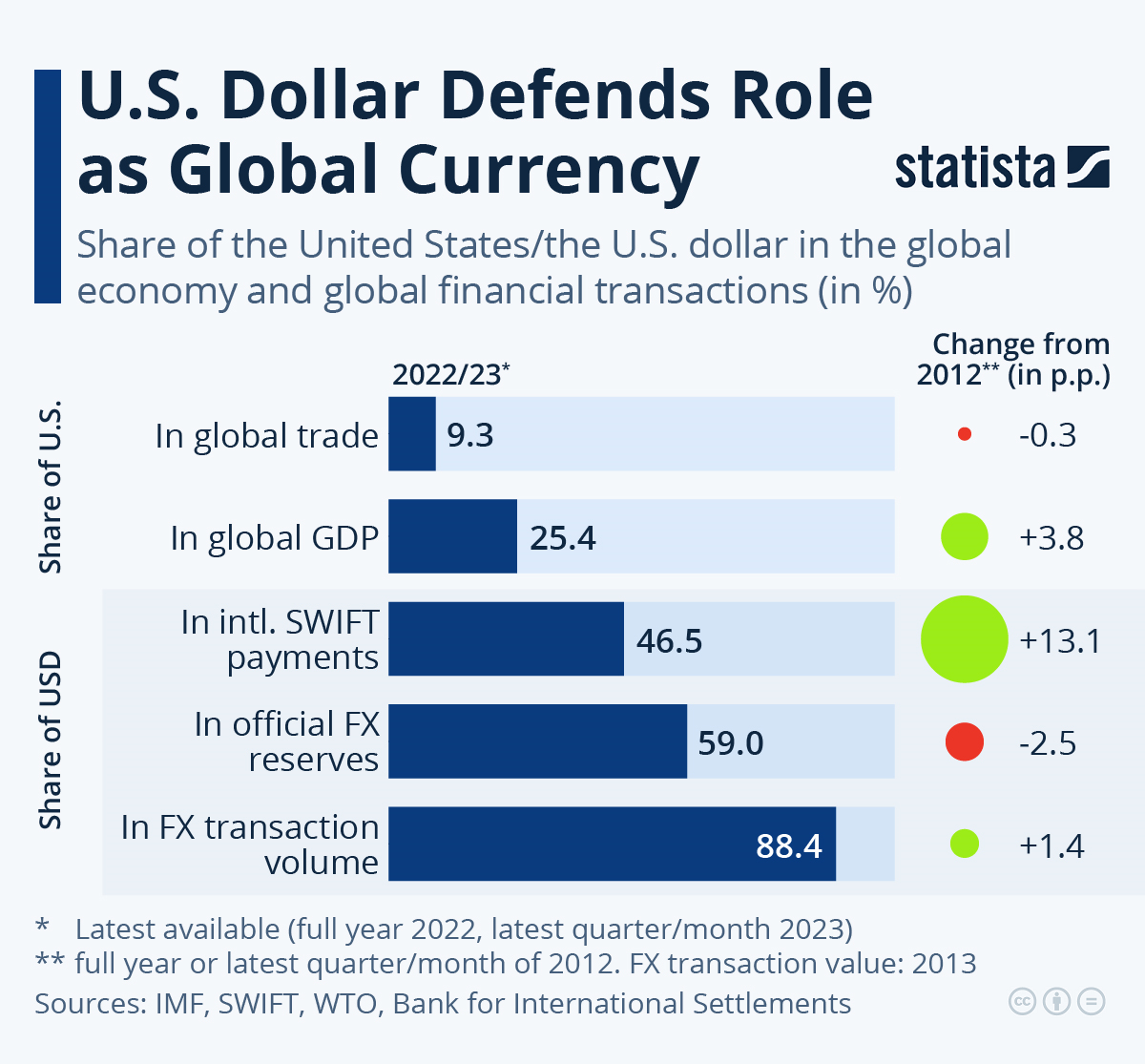

An assessment of exchange and transaction information relating to the US dollar throughout the last ten years uncovers a persevering fortress of the dollar in worldwide business sectors. Regardless of the US contributing simply around 10% to worldwide exchange items and business benefits, the US dollar keeps on applying a lopsidedly huge job in worldwide exchange, stores, and cash trade, fundamentally because of its significant remaining in worldwide capital business sectors and global obligation, as fastidiously reported by Reuters.

In July, global SWIFT installments in US dollars arrived at an untouched high, representing a sizable 46.5% of all installments. This addresses a critical increment of in excess of 13% focuses from December 2012. In equal, the Chinese yuan, long viewed as a possible challenger to the dollar's strength, arrived at another high with an exceptionally low extent of just 3% of every single unfamiliar exchange.

Foreign reserves are one area where the yuan has made more notable progress, albeit still within limited bounds. The US dollar's proportion of international foreign reserves has gradually declined over the last decade, losing 2.5 percentage points, and has dropped by 7.5 percentage points over the last two decades. In contrast, the yuan's proportion of worldwide foreign reserves has increased, albeit slowly, from 1.1% at the end of 2016 to 2.6% now. Nonetheless, the dollar maintains its monopoly on foreign exchange transactions, with almost 88% of such transactions involving the US dollar in 2022.

In conclusion, the BRICS summit has subtly thrown a spotlight on the quirks and idiosyncrasies of the global financial system, with the U.S. dollar playing the lead role. While the dollar might have its quirks, it's not ready to relinquish its throne just yet. So, whether you're dealing in dollars, yuan, or any other currency, remember that the world of finance is a stage, and the currencies are merely players. It's a drama that unfolds every day, and we're all just here to enjoy the show.

Chart via Statista

Read next: PayPal is the Most Popular Mobile Wallet According to This Survey

An assessment of exchange and transaction information relating to the US dollar throughout the last ten years uncovers a persevering fortress of the dollar in worldwide business sectors. Regardless of the US contributing simply around 10% to worldwide exchange items and business benefits, the US dollar keeps on applying a lopsidedly huge job in worldwide exchange, stores, and cash trade, fundamentally because of its significant remaining in worldwide capital business sectors and global obligation, as fastidiously reported by Reuters.

In July, global SWIFT installments in US dollars arrived at an untouched high, representing a sizable 46.5% of all installments. This addresses a critical increment of in excess of 13% focuses from December 2012. In equal, the Chinese yuan, long viewed as a possible challenger to the dollar's strength, arrived at another high with an exceptionally low extent of just 3% of every single unfamiliar exchange.

Foreign reserves are one area where the yuan has made more notable progress, albeit still within limited bounds. The US dollar's proportion of international foreign reserves has gradually declined over the last decade, losing 2.5 percentage points, and has dropped by 7.5 percentage points over the last two decades. In contrast, the yuan's proportion of worldwide foreign reserves has increased, albeit slowly, from 1.1% at the end of 2016 to 2.6% now. Nonetheless, the dollar maintains its monopoly on foreign exchange transactions, with almost 88% of such transactions involving the US dollar in 2022.

In conclusion, the BRICS summit has subtly thrown a spotlight on the quirks and idiosyncrasies of the global financial system, with the U.S. dollar playing the lead role. While the dollar might have its quirks, it's not ready to relinquish its throne just yet. So, whether you're dealing in dollars, yuan, or any other currency, remember that the world of finance is a stage, and the currencies are merely players. It's a drama that unfolds every day, and we're all just here to enjoy the show.

Chart via Statista

Read next: PayPal is the Most Popular Mobile Wallet According to This Survey